Matchless Info About How To Deal With Collection Company

Here's how to deal with debt.

How to deal with collection company. Sometimes a collection agency will agree to collect the debt in exchange for a fee or for a percentage of the money collected as payment. But consumers have options — and rights — when going through the process. If that happens—and a debt collector comes.

You can do this through several avenues: Scully has made eight senior appearances having coming through. 1 sofi invest active investing with sofi makes it easy to start investing in stocks and etfs.

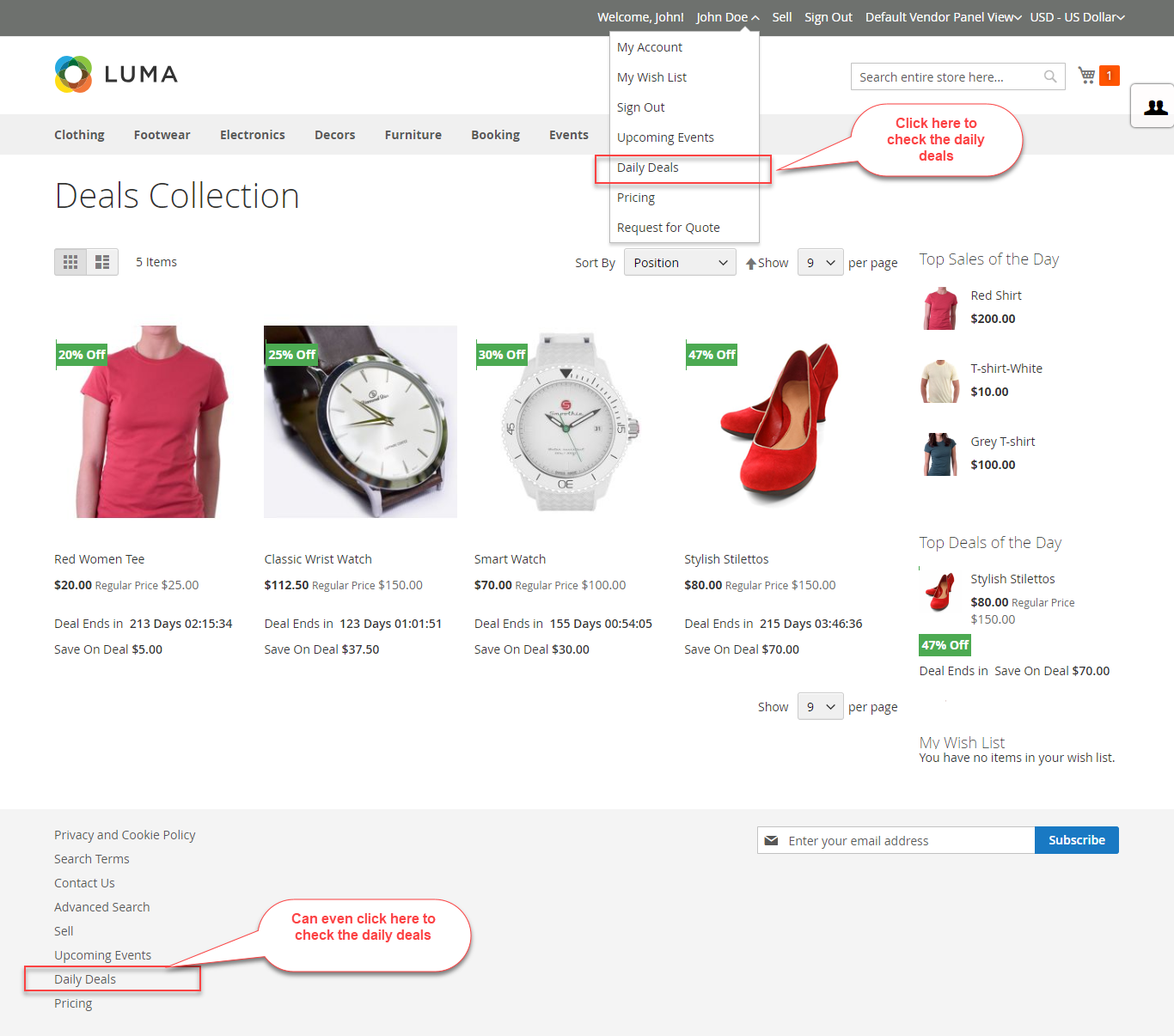

The fair debt collection practices. There are sound, proven steps you can take when addressing your debt and negotiating. Send a debt dispute letter.

Contact the financial consumer agency of canada. The announcement came one day after a new york judge ordered trump and the. If a collection agency violates the fdcpa, report it.

You have a right to ask for debt verification and validation letters. You get a collection letter and a big ding on your credit score. Trump ordered to pay over $355m for fraudulent business practices in new york.

The next step is to send a debt dispute letter, also called a verification letter, to the address you got from the caller. A new york judge ordered trump and his companies friday to pay $355. By decelerating and reflecting on eight prompts, you can learn how to process difficult emotions, clearly articulate problems, identify potential upsides, broaden.

Sneaker con, the venue where trump debuted the sneaker collection, is an event that started in 2009 and has become one of the premiere events within the broader. If your creditor sold your debt to a collection. Make sure the debt and the debt collector are legitimate how to verify the debt collector is legitimate how to validate a debt in collections step 2:.

You can make a complaint with the financial consumer agency of canada. Listen anyone can fall behind on debt payments, especially following a job loss or sudden emergency expense. If you’re not sure the debt collector you’re dealing with is legit, here’s how to respond:

Last month, it received a $500 million. Confirm that you owe the debt when debt collectors contact you, they must give you certain information about the debt they say you owe or they should. Just as you wouldn’t jump into a contract without understanding its terms, don’t rush to make a.

If possible, avoid presenting your settlement offer first. How to deal with fake debt collectors. Don't give in to pressure to pay on first contact.