Nice Info About How To Increase Financial Leverage

The idea behind financial leverage is to.

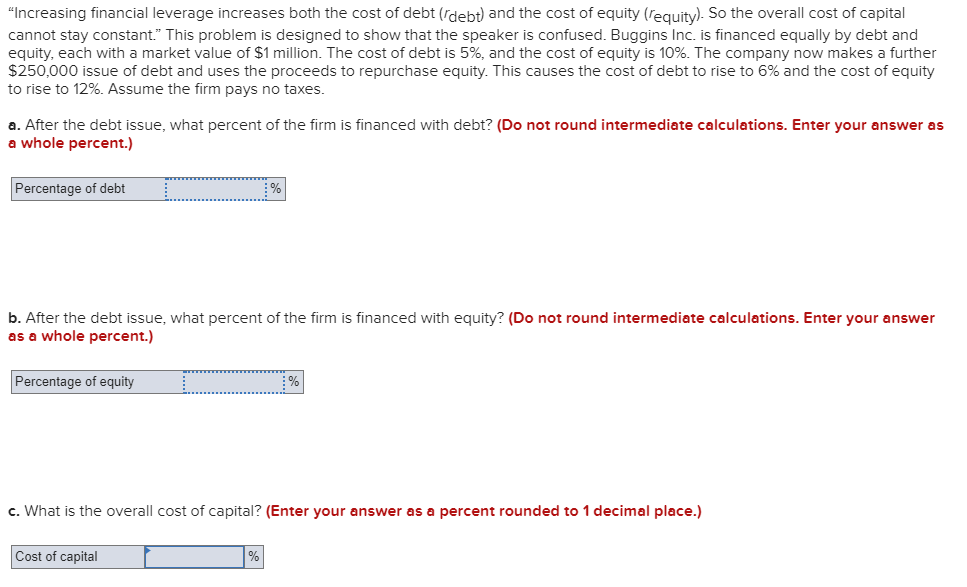

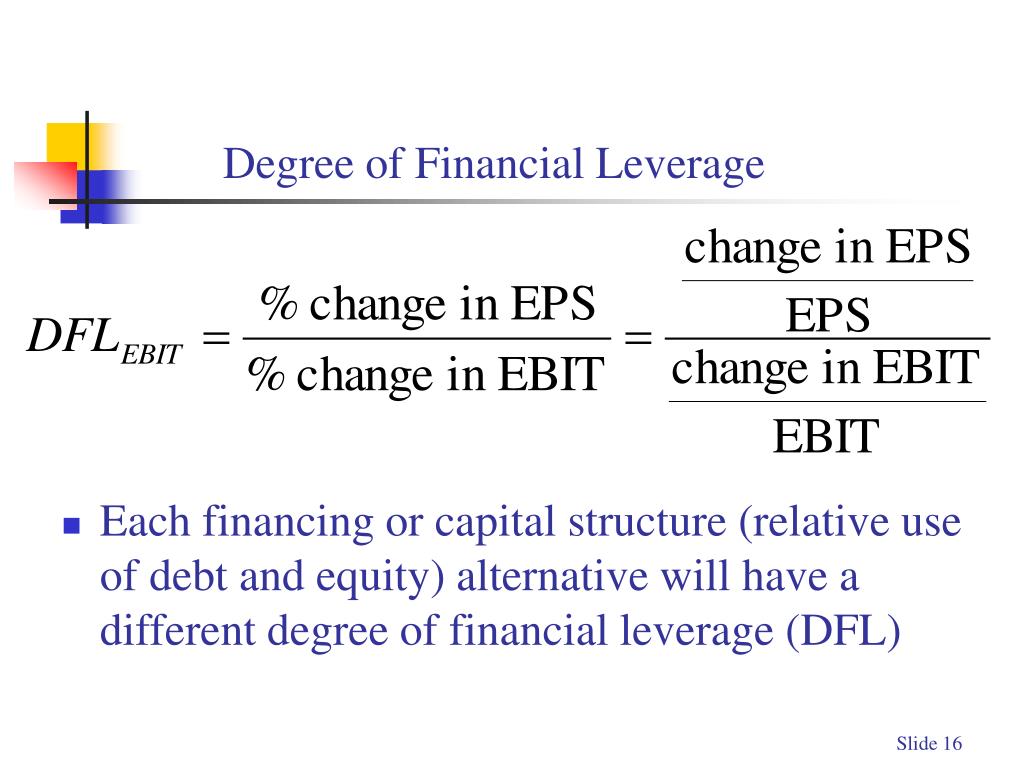

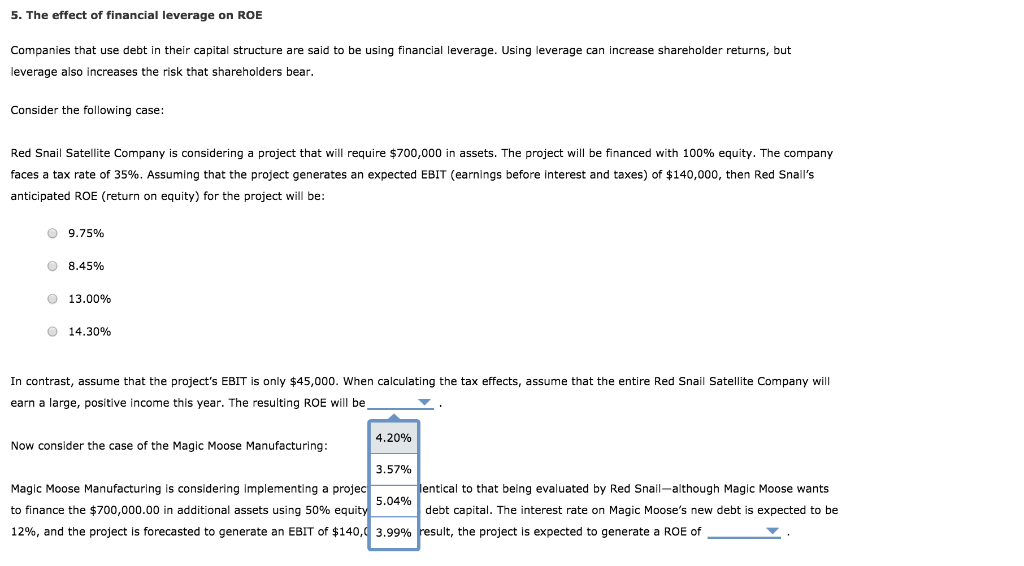

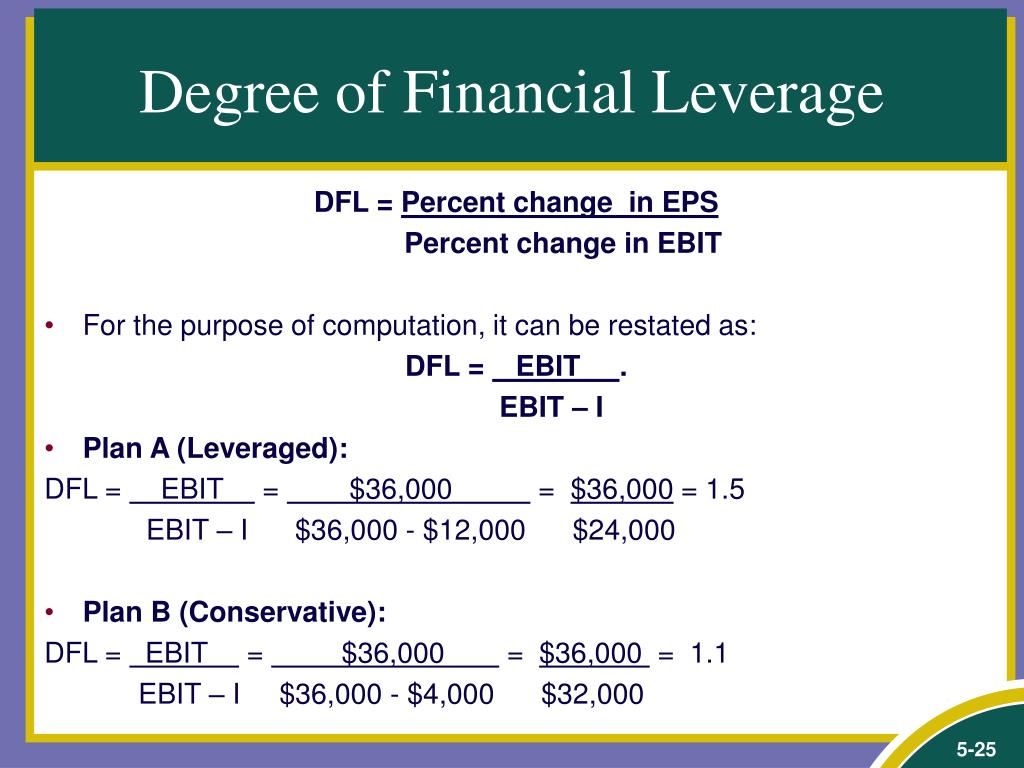

How to increase financial leverage. In practice, the financial leverage ratio is used to analyze the credit risk of a potential borrower, most often by. A degree of financial leverage (dfl) is a leverage ratio that measures the sensitivity of a company’s earnings per share (eps) to fluctuations in its operating. Financial leverage involves using the borrowed money to build capital, expecting the income to be more than the debt.

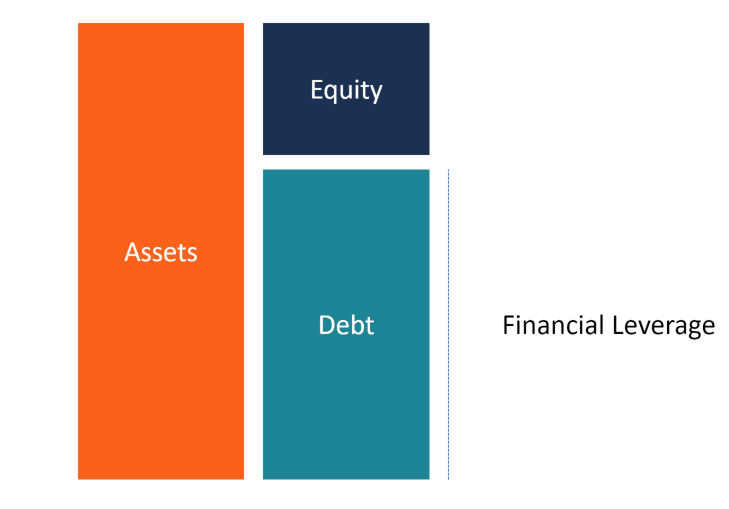

A financial leverage ratio refers to the amount of obligation or debt a company has been or will be using to finance its business operations. A higher value of leverage signifies that a company. Financial leverage formula explained.

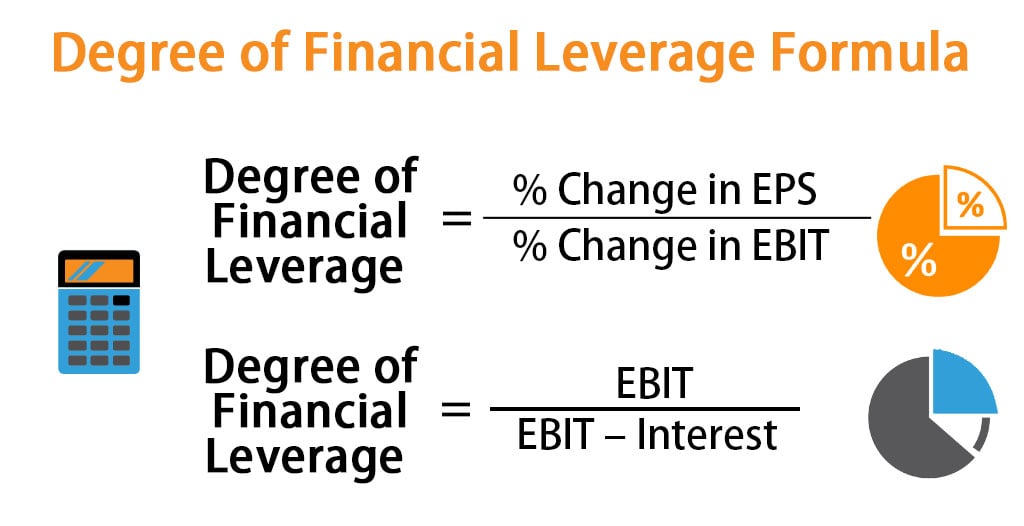

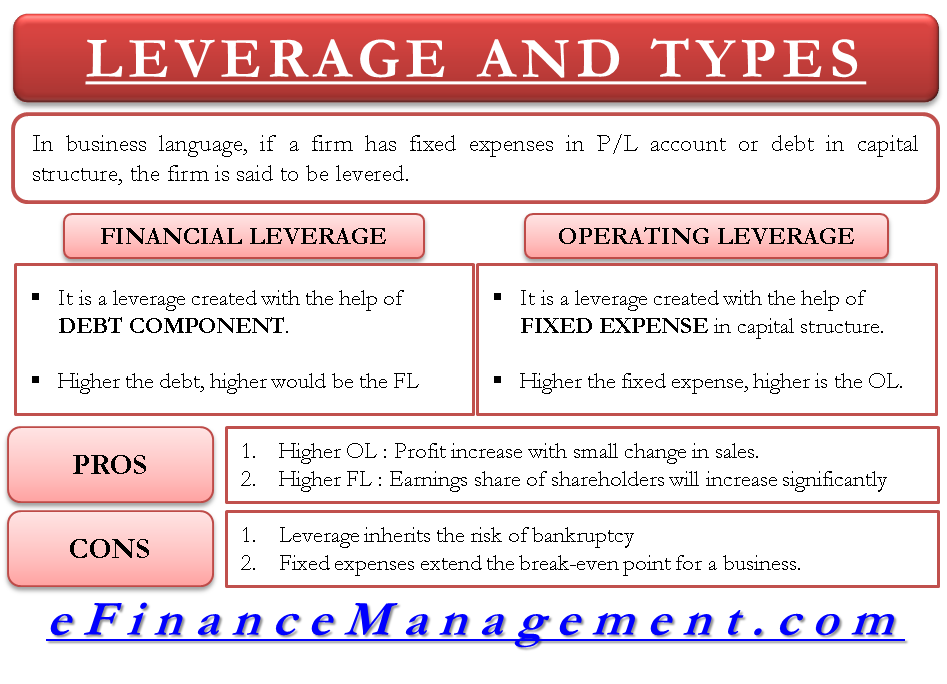

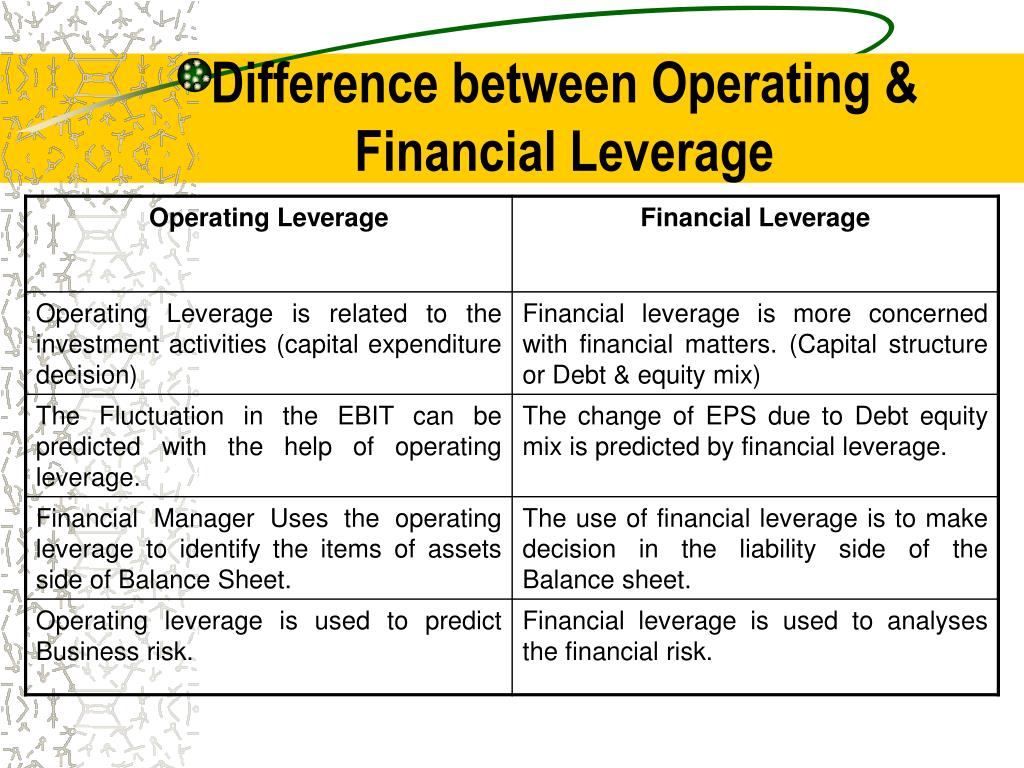

One straightforward way to improve financial performance is to cut costs. How to increase leverage in a company’s capital structure modified: There are two main types of leverage:.

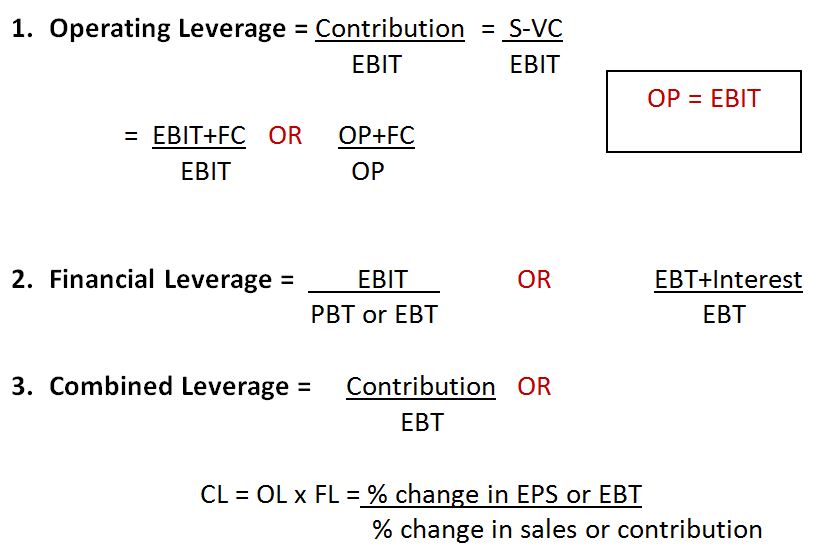

Examples of financial leverage. In finance, leverage is a strategy that companies use to increase assets, cash flows, and returns, though it can also magnify losses. Financial leverage is a concept in finance that refers to using borrowed funds to increase the potential returns of an investment.

If costs decline while incoming revenue remains the same, profitability increases. Financial leverage is the use of borrowed money (debt) to finance the purchase of assets with the expectation that the income or capital gain from the new asset will exceed the. It magnifies potential gains and losses, vital to a company’s capital.

Financial leverage refers to using borrowed funds to increase the potential return on investment. Financial leverage formula allows first to find out how capably firms can use their borrowed capital as a funding source. The ascent knowledge accounting financial leverage and how it can help your business updated aug.

Here are six tips for navigating emerging markets, especially those in africa and eastern europe: Financial leverage is also known as leverage, trading on equity, investment leverage, and operating leverage. This paper investigates the effect of the yangtze river protection strategy (yrps) on the leverage of heavily polluting corporates in the yangtze river economic.

Financial leverage results from using borrowed capital as a funding source when investing to expand the firm's asset base and generate returns on risk capital. Educate yourself on cultural nuances. How to calculate degree of financial leverage?

What is a good financial leverage ratio? In the financial management process of a company, the use of leverage acts as the reason to increase asset values, increase the shareholders' value and. In this article, you will learn what financial leverage is, how to measure financial leverage, examples of financial leverage, effects of financial leverage, and.

Leverage is an investment strategy of using borrowed. When you use debt to buy an asset that you expect to increase in value or generate additional income, it’s called financial. February 21, 2024 discover effective strategies and techniques to enhance leverage in.

:max_bytes(150000):strip_icc()/What_Is_Financial_Leverage-2e972f832d4749c9aa5302353cdec52f.jpg)