Outstanding Info About How To Prepare For A Financial Collapse

Our economic collapse preparation list covers all you need to prepare for the next financial crisis and disaster.

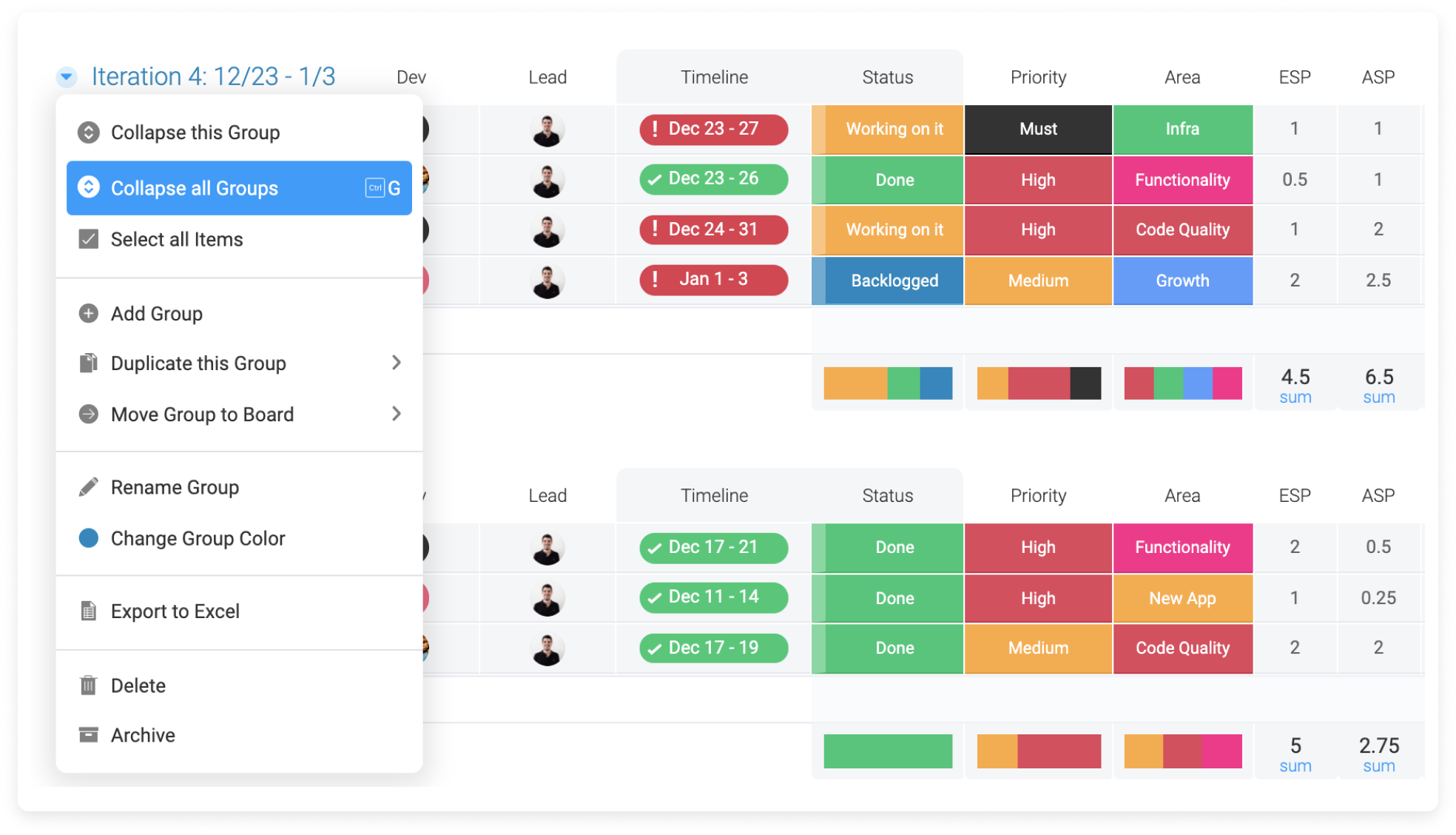

How to prepare for a financial collapse. Pick a percentage of your income—say, 90%—and set up an automatic transfer that will send that money to a designated checking account each pay period. There’s a $1.7 trillion industry that’s ready to help. 24, 2024 3 am pt.

Many people tend to make investment decisions based on emotions. The liquidator’s talks with lawyers are an early sign of how this latest phase of evergrande’s collapse, which began when a hong kong court last month ordered it to. In truth, there is no one “model” for economic collapse.

Cut back on unneeded expenses. [2] if you are living paycheck to paycheck and you lose your job during. And if you are in a crypto community, think deeply about realizing the.

In the wake of the global financial crisis, yale som’s andrew metrick and former treasury secretary timothy geithner founded the yale program on financial. The worst thing about a financial collapse is that you. Review your budget, recurring bills and spending habits to identify where you could reduce your costs or cut something out completely.

The debt overhang presumes that if the economy is growing at a fast enough rate, tax receipts will outpace the government’s borrowing costs. Such a fund would ideally cover three. Prepare to pay home property taxes.

Some suggest that unconventional monetary measures may provide the scope to respond to a crisis through negative rates, forward guidance pledges to hold. During booms, they might become overly confident, optimistic and. The ability to quickly access liquid assets will be foundational if an individual or family is faced with a.

By reflecting on the lessons from the responses to past crises, governments will be better prepared to respond more effectively when faced with the next crisis. There could be a 10% correction coming to stocks, according to. Private credit came of age after the 2008 financial crisis as an alternative to banks at a time when regulators were.

Financial resilience provides a safety net that you might rarely use — but when you need it, you’ll be glad you have it. Keep cash in small bills. One of the most important factors on a.

How to be prepared for an economic collapse. Roth expects at least 100 more to fail. Assess your budget and categorize crucial spending needs.

The two largest companies in the industry, sunrun and sunnova, both posted big losses in their most recent quarterly. Optimizing operational expenses is usually among the top considerations for business owners when these situations arise. Active investing with sofi makes it easy to start investing in stocks and etfs.

/https:%2F%2Fspecials-images.forbesimg.com%2Fdam%2Fimageserve%2F1077688038%2F0x0.jpg%3Ffit%3Dscale)