Glory Tips About How To Stop Tax Offset

For example, if you owe the.

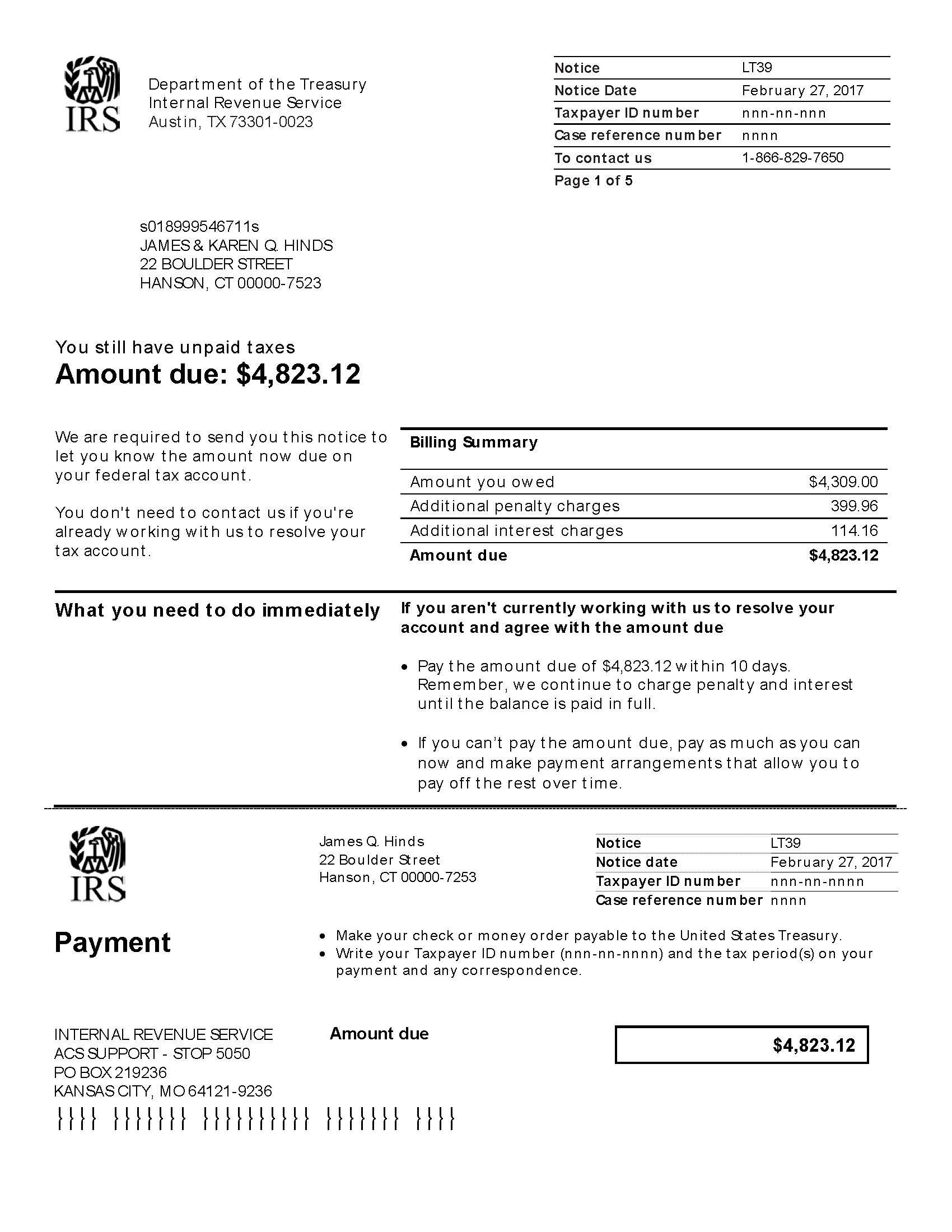

How to stop tax offset. The tax office’s data also shows that in 2023, the total number of offsets was 11% higher than in 2022, when this type of revenue loss reached r$215 billion. To put the tax offset on hold while. 1 min read the bureau of fiscal services will send you a notice if there’s a refund offset.

To prevent future offsets, prioritize settling any outstanding debts, especially those commonly subject to tax refund offsets, like federal tax or child support arrears. If you received a delinquent debt notice or are missing money from your federal tax refund, paycheck, or. Avoid getting a tax refund offset.

You'll receive a notification first if the bfs has a current mailing address for you. Here’s an example of how you can lower your income tax by investing in a 401 (k). It will tell you how much.

If an individual owes money to the federal government because. The best way to avoid a tax offset is for taxpayers to pay any of their dues on time to avoid incurring debts. The treasury offset program (top) is used to offset federal income tax refunds, tax credits, or any other federal payment program to pay off certain outstanding.

Taxpayers can avoid a tax refund offset through: If an individual owes money to the federal government because. The irs states that you must appeal to the department of education to challenge a tax offset after it’s already occurred.

How to prevent tax offsets the basics of tax offsets first, tax offsets are legal. You should receive a notice of intent to offset, letting you know that you won't be receiving some or all of your tax refund this year. For example, if you are in the top tax bracket of 37% and make a $6,500 deductible contribution—the maximum for 2023—you can save as much as $2,405 in.

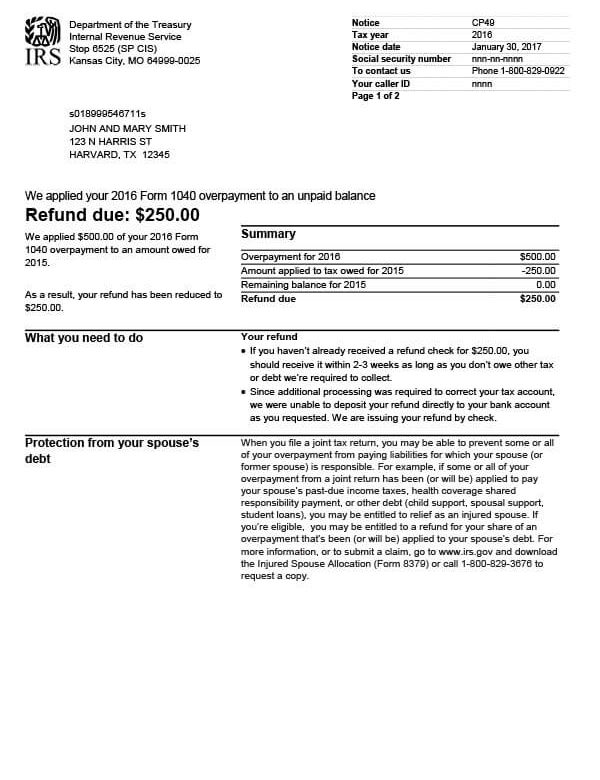

In connection with an erc refund for 2020 or 2021, the company (and in some cases, its owners) is required to amend corporate and individual income tax. The amount of my federal payment (e.g., income tax refund) has been reduced (offset). Budgeting properly via an irs installment plan for debt, applying.

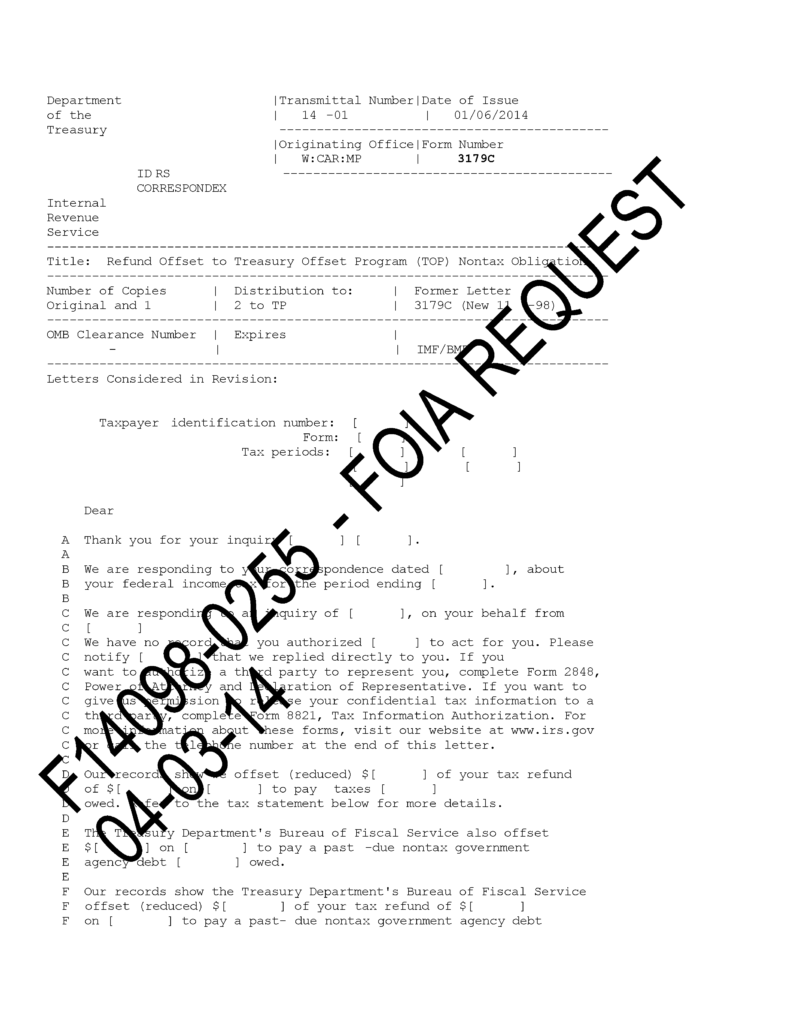

This is through documents or paperwork online or filled out and. The internal revenue service (irs) can take the amount owed to it out of your federal income tax refund. This is known as an offset.

The treasury offset program, created in 1986 and overseen by the bureau of. The notice will identify the agency or creditor that will receive your refund. The amount of my federal payment (e.g., income tax refund) has been reduced (offset).

Say you contribute 5% of your. List of partners (vendors) the new policy, known as 'ir35 offset', aims to prevent double taxation by empowering hmrc to offset tax and national insurance contributions. To check your refund status, you will need your social security number or itin, your filing status and the exact refund amount you are expecting.