Impressive Info About How To Apply For Unsubsidized Loans

If you’re using federal financial aid to pay for college, you may.

How to apply for unsubsidized loans. To learn more about each type of federal student loans and how you can apply for them, click on the following links. You can also download the student loan checklist to help. Direct unsubsidized loans:

Like most federal loans, the application for direct unsubsidized loans is through the fafsa or free application for federal student aid. You can choose from fixed or variable rates. Published 5:21 am edt, wed january 10, 2024.

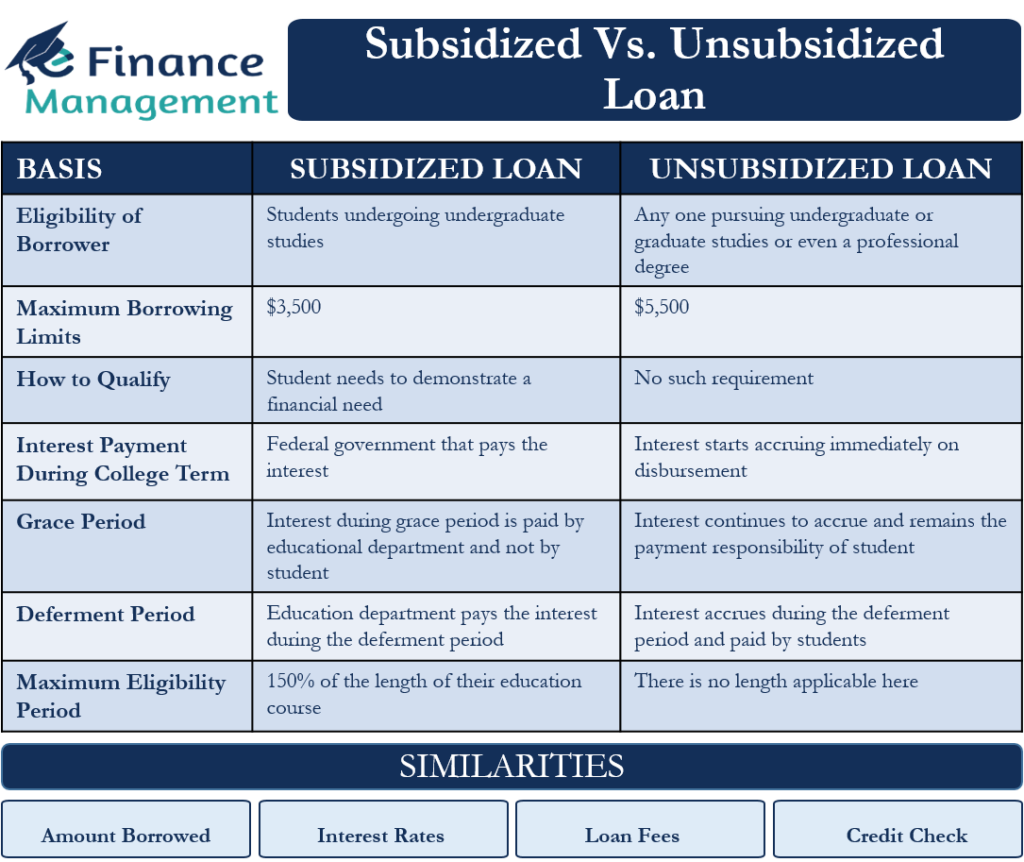

How do you apply for a federal direct unsubsidized loan? Here’s a breakdown of the annual borrowing limits for dependent students: The plan eliminates 100% of the remaining interest for both subsidized and unsubsidized loans after a scheduled payment is made.

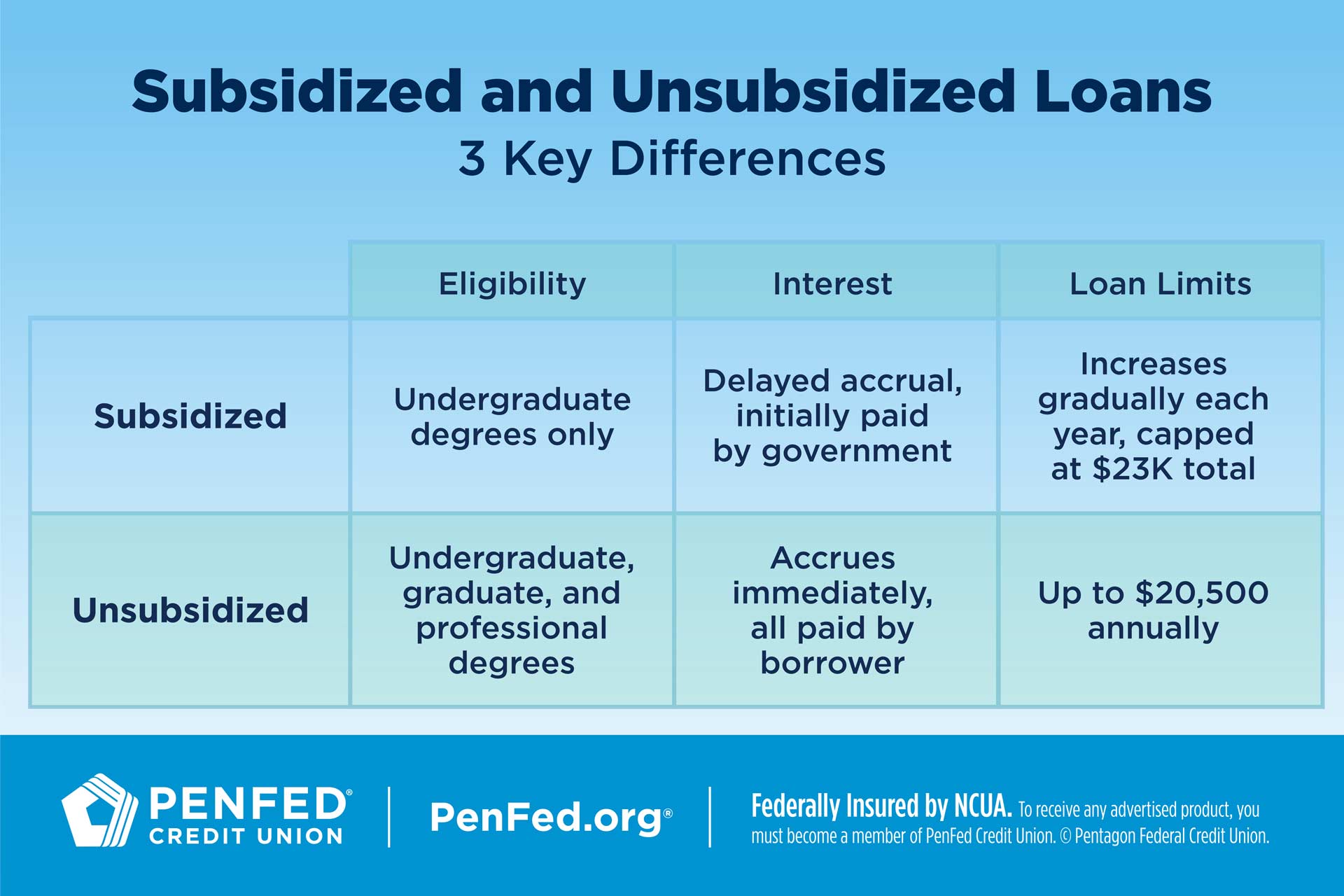

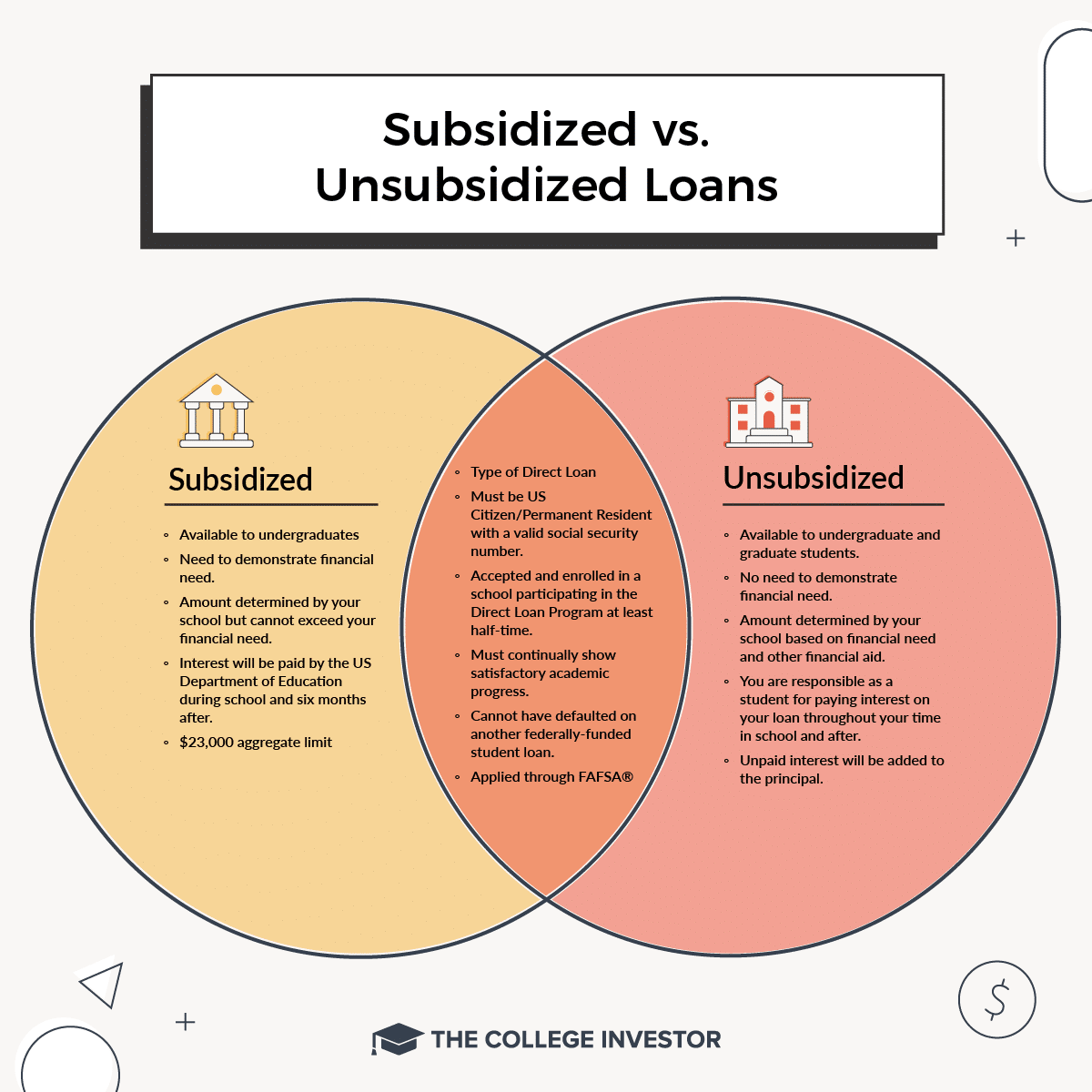

To be eligible, the student must: Are federal student loans offered by the u.s. One benefit of unsubsidized loans is they’re available to a wider range of students.

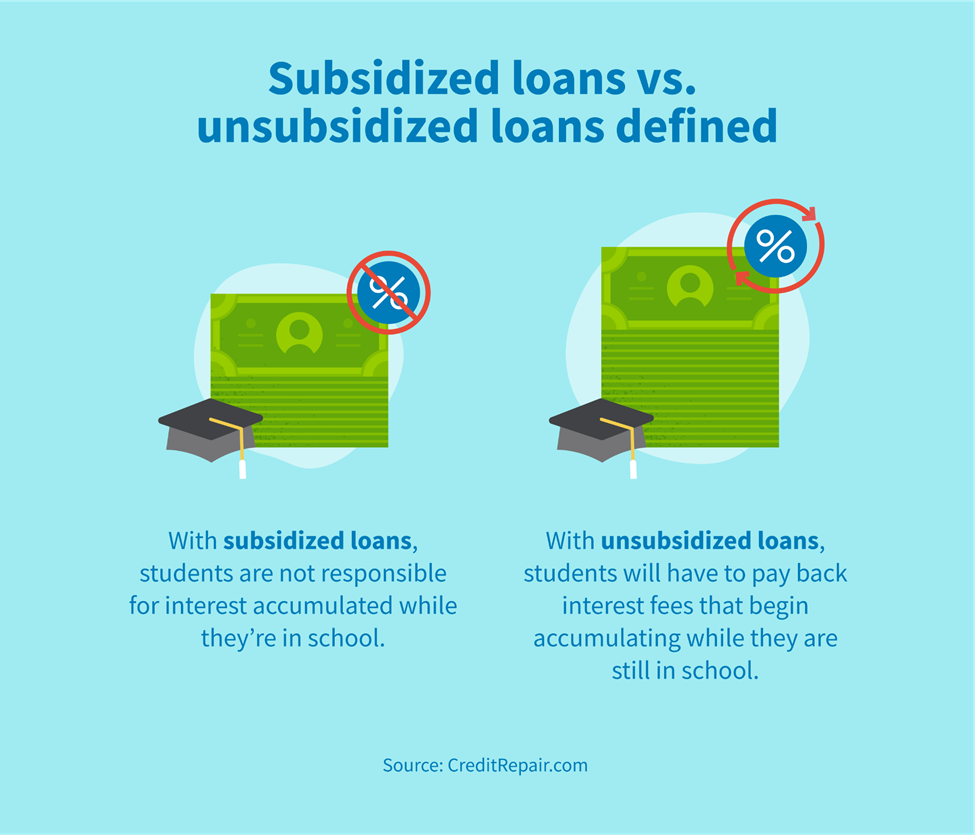

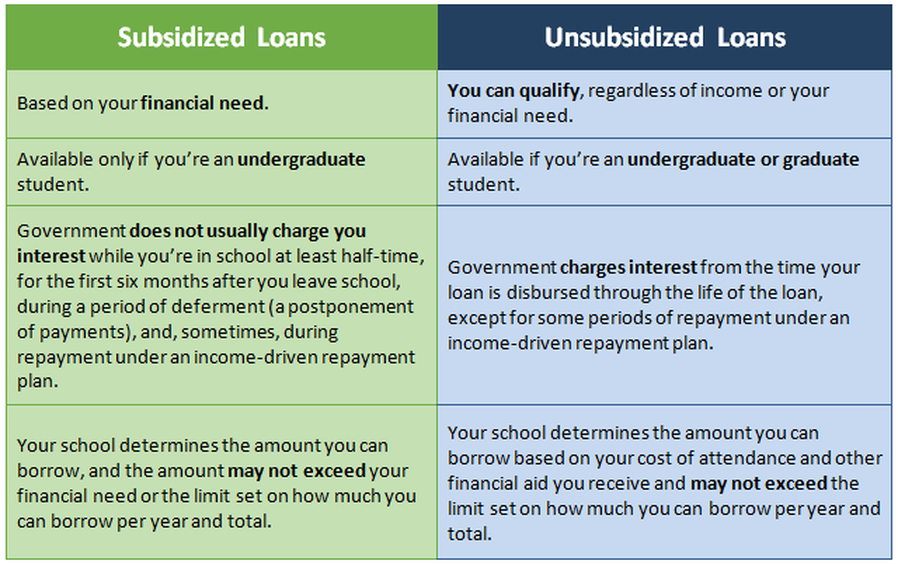

These loans provide a means to cover. To be eligible for direct subsidized/unsibsidized loans, you must meet federal and penn state. Both direct subsidized loans and direct unsubsidized loans.

Who is eligible for unsubsidized student loans? If the loan is not approved, the office of student financial aid will automatically increase the student unsubsidized loan up to an additional $4,000/$5,000 for the award year. Subsidized loans are awarded based on financial need.

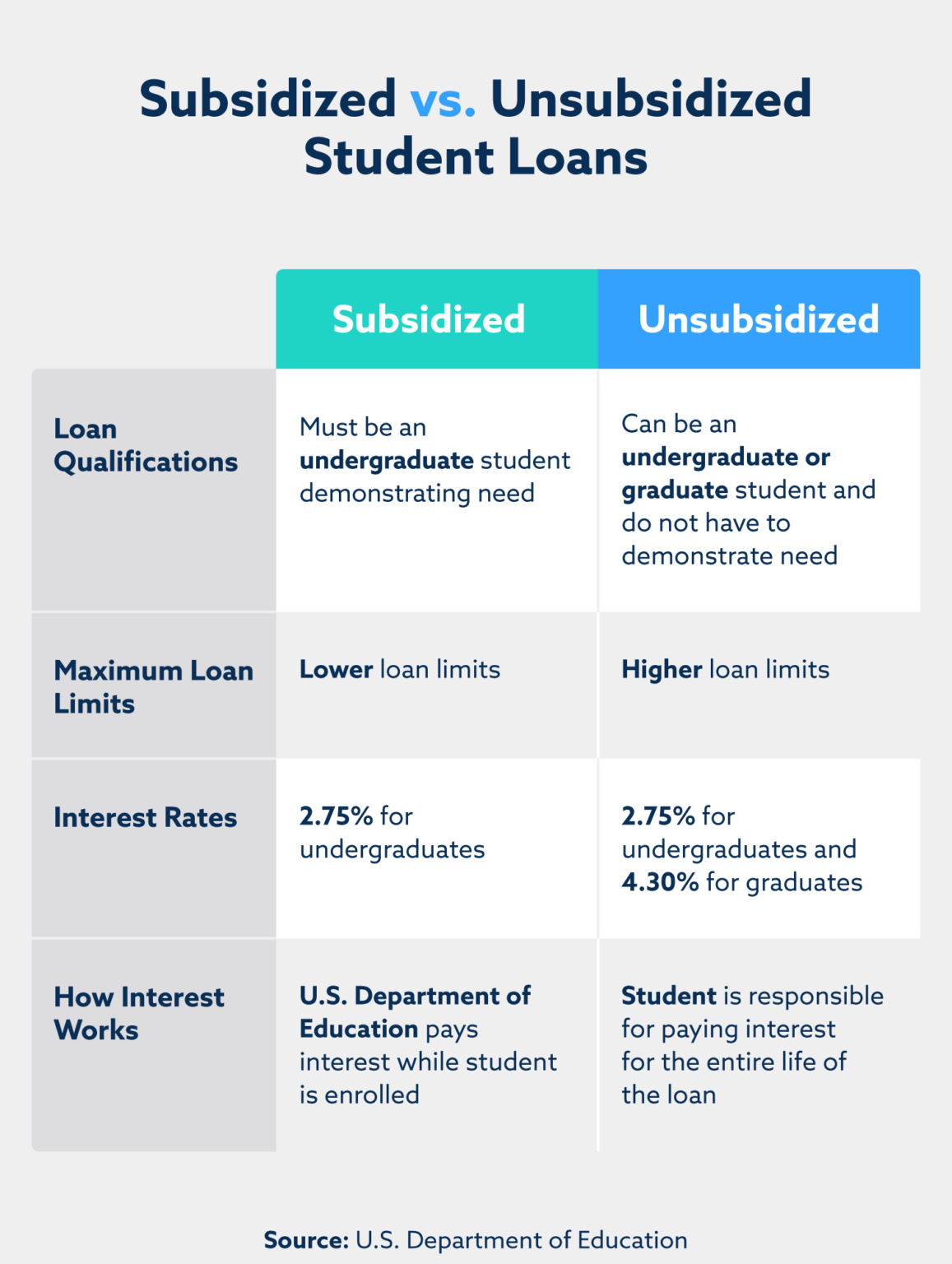

How much can i borrow using unsubsidized student. Apply for an idr plan now. Graduate students can receive up to $20,500 per year (or more for professional students) in unsubsidized loans.

In this guide: The aggregate borrowing limit for unsubsidized loans could reach $31,000 to $57,500, based on your subsidized loan borrowing amount and dependency status. A spouse will not need to.

The department of education provides federal direct unsubsidized student loansas one of four options under the william d. Ford federal direct loan program. Loan amounts are based not on financial need, but on costs of school.

How to apply for federal direct subsidized/unsubsidized loans. What about private student loans? Request and fill out a.

:max_bytes(150000):strip_icc()/federal-direct-loans-subsidized-vs-unsubsidized-Final-f0f41bb91a7143fbb1657b8d352c6ae7.png)