Fantastic Tips About How To Buy Government Bonds In India

Market guide government bonds india government bonds india bond and debenture by 5paisa research team last updated:

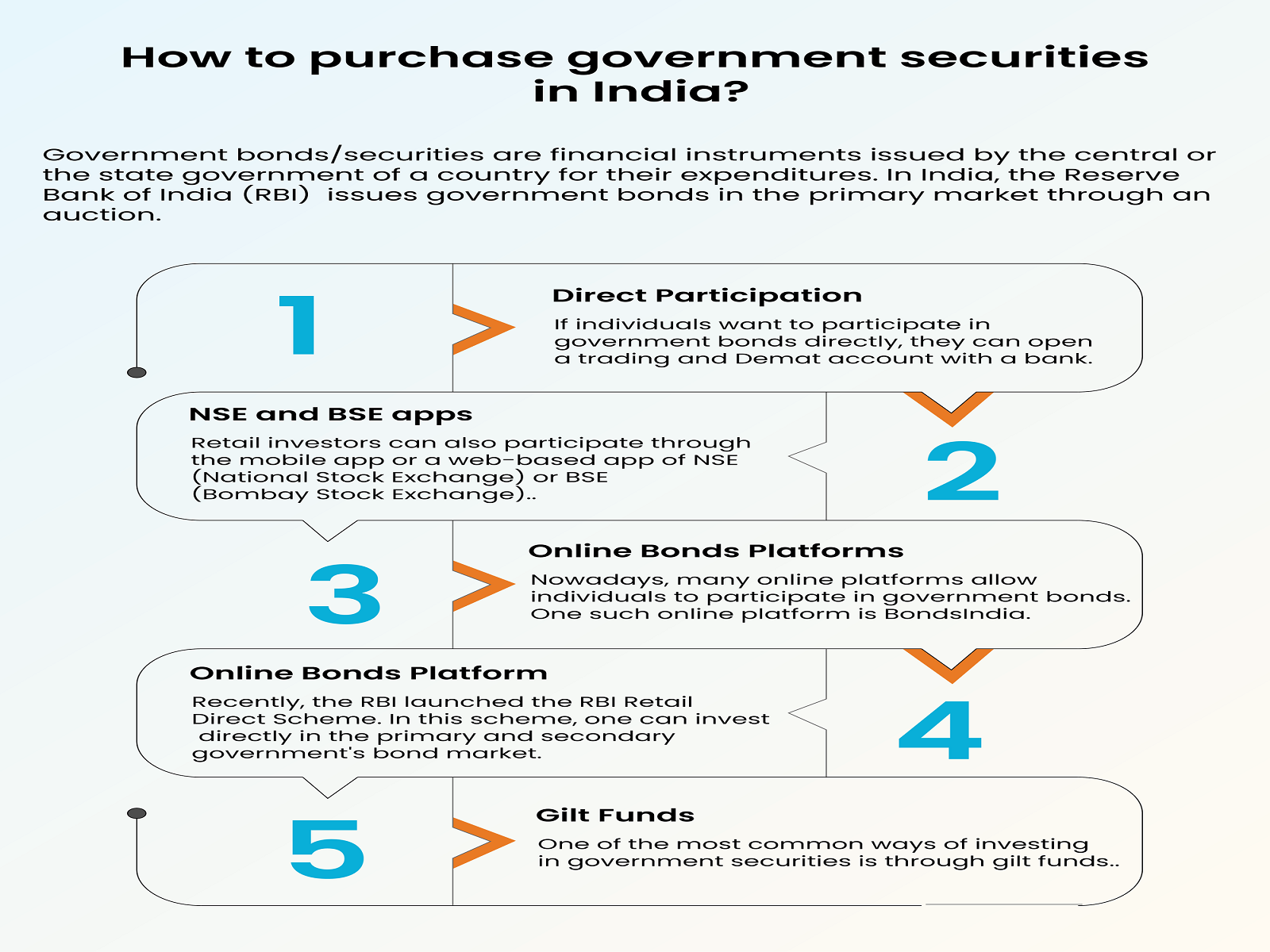

How to buy government bonds in india. Foreigners pursue every route to access hot india bond trade. Government bond in india is essentially a contract between the issuer and the investor, wherein the issuer guarantees interest earnings on the face value of bonds held by. Some ways to buy government bonds in india are:

How to buy government bonds in india? Gilt mutual funds (mfs) and. Investors who successfully apply will receive their sgbs on february 21, 2024.

These funds are a category of debt mutual funds that solely invest in. How to buy government bonds in india? Buying government bonds offers a reliable income source and.

How to invest in government bonds online writer # indiabonds | august 6, 2022 introduction in a buffet of debt investments, while the humble government bonds. The price at which you invest in a bond. Government bonds can be bought by investors through various channels in india.

Learn more about what are government bonds in india & how to invest & buy government bonds, at upstox.com. The price for the bonds will be announced by the reserve bank of india (rbi) soon. Explore the stability, fixed returns, and tax.

Investors can buy government bonds offline and online as well. The government, too from time to time, issues bonds to the public to raise capital. Now that you know all about government bonds, it is time to learn how to buy govt bonds in india.

Also, learn about interest rates, meanings, &. How to buy government bonds in india? One way to buy government.

What is the procedure to buy government bonds? 98, 97 etc.) or par (100), or a premium to par (101,102 etc.). How to buy government bonds?

These auctions are typically conducted every week, and. Supranational debt an investor favorite to access india market. Who should invest in government bonds?

Gilt mutual funds gilt mutual funds can be a convenient option if you want to invest in government bonds. Yields as the market fully priced in the shift in the federal. All the funds received from the public can be used for building roads and schools, investing in public projects, and.

:max_bytes(150000):strip_icc()/WherecanIbuygovernmentbonds1_2-8e2ac360d217459eb54ebea0070eb5b5.png)